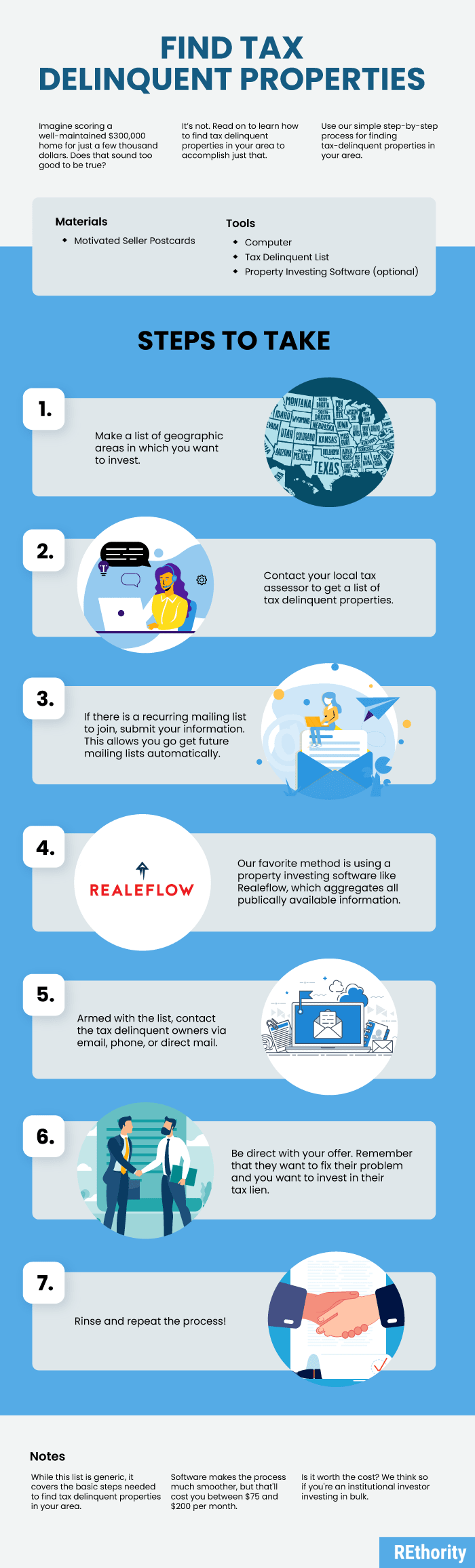

when are property taxes due in williamson county illinois

M-F 800am - 400pm. Please remember that the county is not selling the property at the sale but rather the unpaid.

Williamson County 2021 Property Tax Payment Deadline January 31 2022 Ke Andrews

Cook County and some other counties use this.

. May 28 Mail Tax Bills. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. A reviewed value is then taken times a combined rate from all taxing entities together to set tax due.

Tax amount varies by county. Tax Rates and Tax Levy. The median property tax in Williamson County Illinois is 1213 per year for a home worth the median value of 87600.

Taxing units include cities counties. December 8 2021 by 4pm. According to Illinois State Statute the County Treasurer must hold an annual tax sale to sell unpaid property taxes.

Last day to pay with credit card. This exemption freezes the assessment on your property if your total household income is 6500000 or less. Ad Tax Due Dates Filing Deadlines IRS Tax Calendar.

The Williamson County Treasurer sends out tax bills to property owners once a year with two due dates that are due usually the 1st part of July and early September. We are located on the second floor of the Williamson County Administrative Complex Suite 203 PAYMENT METHODS. In most counties property taxes are paid in two installments usually June 1 and September 1.

March 7 Sent off final abstract. This exemption does not freeze your tax rate. Last day to pay to avoid Tax Sale.

Holiday Closings For 2021. After September 25th a 10 fee PER PARCEL will be added in addition to the 1 12 per month late fee. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

Treasurers Office Suite 125 Edwardsville IL 62025. Williamson County collects on average 138 of a propertys assessed fair market value as property tax. Illinois has one of the highest average property tax rates in the.

July 12 Sept 1215 Penalty on 1st Installment. Those entities include your city Williamson County districts and special purpose units that make up that composite tax levy. The present-day market value of real estate situated in Williamson is calculated by county assessors.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Illinois is ranked 1156th of the 3143 counties in the United States in order of the median amount of property taxes collected. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a.

Make sure you have your parcel number. Taxes 2022 Williamson TN 2022 Williamson TN. The median property tax on a 8760000 house is 91980 in the United States.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. May 3 Co Clerk Extends Taxes.

Visit one of the nearly 100 collector banks and credit unions across Madison County. The median property tax on a 8760000 house is 120888 in Williamson County. Welcome to Property Taxes and Fees.

Welcome to Williamson County Illinois. In person from 830 am. A wide variety of property tax exemptions are available in Williams County which may lower the propertys tax bill.

The Williamson Central Appraisal District is located at 625 FM 1460 Georgetown TX 78626 and the contact number is. 407 N Monroe Marion IL 62959 Phone. Therefore the taxable value will be equal to the assessed value.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 407 N Monroe Marion IL 62959 Phone. It freezes the assessed valuation that appears on your tax bill.

The Williamson County Trustees Office is open Monday-Friday800 am 430 pm. Payments not received in the office or US Postmark by the set due date is subject to a 15 penalty per month this is in compliance to Illinois State Statutes. 3 penalty on 1st Installment.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. 173 of home value. That updated value is then taken times a combined levy from all taxing entities together to calculate tax due.

This exemption must be renewed annually. M-F 800am - 400pm. County boards may adopt an accelerated billing method by resolution or ordinance.

In order to keep Will County residents safe during the unprecedented COVID-19 crisis and offer convenient ways to pay Will County Treasurer Tim Brophy has announced alternate deadlines and methods to pay property taxes. The Williamson Central Appraisal District is a separate local agency and is not part of Williamson County Government or the Williamson County Tax Assessors Office. This procedure is supposed to allot the tax burden in an even manner throughout Illinois with even.

Contact ASHLEY GOTT Treasurer Williamson County Treasurer 407 N. September 13 September 25 400 pm. A payment drop box has been installed outside the main entrance of the building and tax payments may be made in our office by mail.

The median property tax on a 8760000 house is 151548 in Illinois. Once again Illinois has mandated statutes that county property assessors are obliged to carry out. 407 N Monroe Marion IL 62959 Phone.

M-F 800am - 400pm. Box 729 Edwardsville IL 62025. These are deducted from the assessed value to give the propertys taxable value.

Madison County Administration Building 157 N. We have no information about whether any exemptions currently apply to this property. July 11 1st Installment Due.

You will be assessed a penalty at 1 ½ per month. Williamson County Treasurer Resources. It is important to maintain the countys tax cycle to ensure revenues are available to continue critical services for our residents.

2018 - 2019 Real Estate Tax Collection Schedule. Call the Williamson County Clerk at 618-998-2110 and ask for an Estimate of Redemption. Property Tax Payment Dates Make checks payable to.

First-time applicants can obtain forms from the County Assessors Office. Property Tax Reform Report. Monroe Street Suite 104 Marion IL 62959 Phone.

Madison County Treasurer PO. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. 173 of home value.

September 12 2nd Installment Due. Property TaxesMonday - Friday 800 - 400. Tax amount varies by county.

Last day to pay with personal check.

Interactive Maps Property Tax Fairness

Property Tax By County Property Tax Calculator Rethority

Things That Make Your Property Taxes Go Up

Williamson County Has Express Property Tax Appraisals For New Homeowners Youtube

Supervisor Of Assessments Williamson County Illinois

Why Are Property Taxes So High In Texas Here Are 3 Reasons

Williamson County Property Tax Rate Approved Ke Andrews

How To Calculate Your Tax Bill

How To Calculate Your Tax Bill

Smith County 2021 Property Taxes Due January 31 2022 Ke Andrews

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Williamson County Treasurer To Send Out Real Estate Tax Bills Friday Withers Broadcasting Webq Am Fm

How To Protest Your Texas Property Taxes Win Home Tax Solutions

Property Tax By County Property Tax Calculator Rethority

Williamson County Il Property Tax Search And Records Propertyshark

West Virginia Property Tax Calculator Smartasset

Illinois Property Tax Exemptions What S Available Credit Karma